How to Select Stocks for Intraday Trading: A Simple Guide

Intraday trading can be highly profitable, but the key to success lies in choosing the right stocks. In this guide, we will explore how to find the best stocks for intraday trading and the essential qualities to look for. Additionally, we’ll discuss common pitfalls and how to avoid them. Whether you’re a beginner or looking to refine your strategies, this guide will help you get a clear understanding.

Why Timing is Everything in Intraday Trading?

One of the most critical factors in intraday trading is timing. No stock is inherently “good” or “bad” for intraday trading. Even the best shares with strong fundamentals will experience price fluctuations throughout the day. This up-and-down movement is what

provides opportunities for intraday traders. Therefore, the timing of your entry and exit is far more important than the stock itself.

Key Qualities to Look for in Intraday Stocks

Not every stock is suitable for intraday trading. Here are three essential qualities that a stock should have to be a good candidate for intraday trading:

- High Liquidity

Liquidity refers to the number of shares being traded in the market. Stocks with high liquidity have more buyers and sellers, allowing you to enter and exit trades quickly. Stocks with high volumes usually involve institutional investors and big players, making them more prone to significant price movements, which is ideal for intraday trading.

- Volatility

The price of the stock must move frequently throughout the trading day. If a stock doesn’t show much price movement, there’s no profit to be made. High volatility ensures there are enough price fluctuations, giving you opportunities to buy low and sell high, or vice versa.

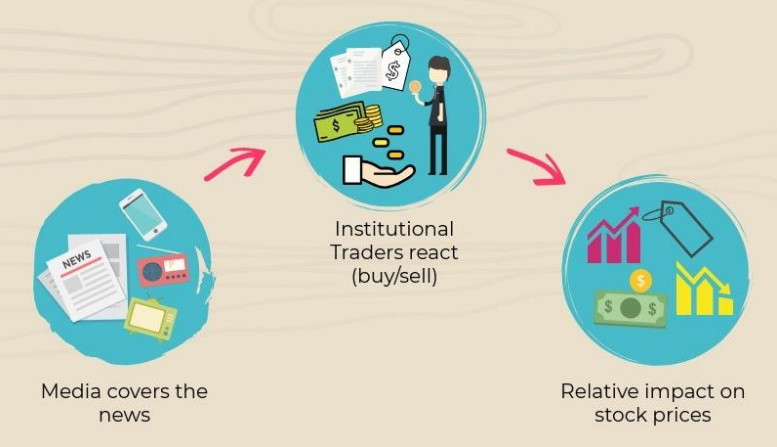

- News Sensitivity

Stock prices often react to news, whether it’s company-specific, sector-specific, or related to broader economic factors. For intraday traders, keeping up with the latest news and understanding its impact on stock prices is crucial. For example, recent government

announcements regarding the real estate sector can significantly influence stock prices in that industry.

Stocks to Avoid for Intraday Trading

Just as some qualities are essential for selecting the right stocks, others can be detrimental. Here are the types of stocks you should avoid for intraday trading:

- Small-cap and Penny Stocks

These stocks are highly volatile but lack liquidity, making it difficult to enter and exit trades quickly. Large and mid-cap stocks are generally better choices for intraday trading as they offer the perfect balance of liquidity and volatility.

- Stocks with Early Circuit Breakers

Stocks that hit upper or lower circuit limits early in the day can trap traders in their positions. When this happens, it becomes impossible to sell or buy, leading to potential losses.

How to Find the Best Stocks for Intraday Trading?

A tool like Chart Ink can make stock selection much easier. Here’s a step-by-step process to find intraday trading stocks using a screener:

- Filter by Volume

High volumes are essential for liquidity. Use Chart Ink to find stocks where the daily trading volume is higher than the previous day. This indicates institutional activity and potential price movements.

- Avoid Penny Stocks

Filter out stocks that are priced below ₹300. Penny stocks can be too risky for intraday trading due to their volatility and lack of liquidity.

- Focus on Market Capitalization

Stick to mid-cap and large-cap stocks, as these offer better liquidity and stability. Stocks with a market cap greater than ₹5,000 crore are generally safer bets.

- Use the ADX Indicator

The ADX (Average Directional Index) helps you determine whether a stock is in a trending phase. A stock with an ADX value between 20 and 50 is ideal for intraday trading, indicating a strong trend.

Example: Triveni Turbine Limited

Let’s take Triveni Turbine Limited as an example. The stock shows high volumes and a significant price movement, making it an excellent candidate for intraday trading. It recently broke a resistance level and is now trending upwards, offering a potential buying opportunity if it retests its support levels.

Final Tips for Successful Intraday Trading

- Set Stop Loss and Target Prices

Always set a stop loss to limit your potential losses. Similarly, set target prices to lock in your profits. Once your target is achieved, avoid over-trading for the rest of the day. Most losses in intraday trading happen due to over-trading.

- Follow a Structured Strategy

Using multiple confirmations, such as moving averages, candlestick patterns, and support/resistance levels, can increase the probability of a successful trade.

Intraday trading requires a disciplined approach, and with the right tools and strategies, you can increase your chances of success. Keep an eye on liquidity, volatility, and news, and always trade with a plan.