Upcoming IPOs to Watch: HDB Financial Services,Swiggy, and Leela Palace

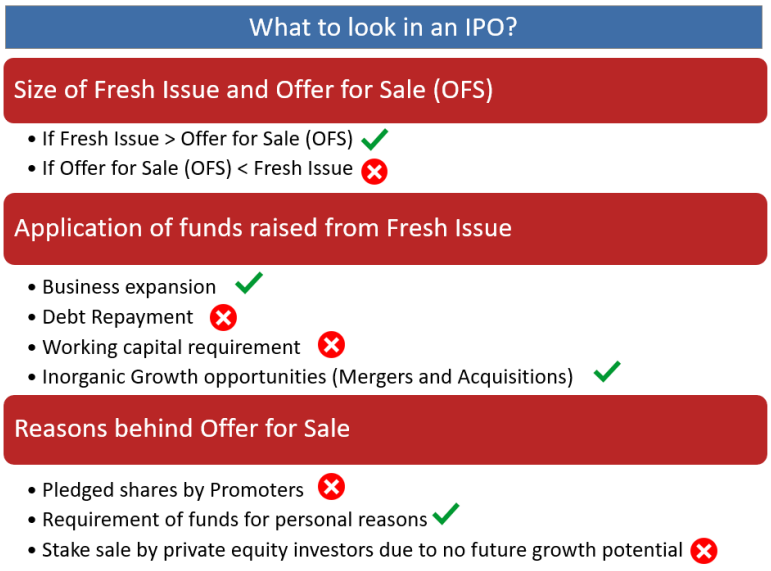

The IPO market is abuzz with excitement, and it feels like hitting the lottery — getting an IPO allotment has become quite the challenge. If you’ve managed to get one, share your story in the comments! Before we dive into the upcoming IPOs of HDB Financial Services, Swiggy, and Leela Palace, it’s crucial to understand the key terms like Fresh Issue and Offer for Sale (OFS).

Knowing these will help you understand where the money raised from the IPO is going and how it affects the company and existing investors.

What Is a Fresh Issue?

In a fresh issue, the company issues brand new shares to the public. The money raised through this goes directly to the company, which can use it for growth, expansion, or debt repayment.

An easy way to understand this is through a simple Aloo Paratha example:

Imagine a company is like an Aloo Paratha cut into 10 pieces, and these pieces represent the shares. When the company does a fresh issue, it cuts the Aloo Paratha into 15 pieces instead of 10, selling an additional 5 pieces to the public. The money from selling these extra pieces goes back to the company, allowing it to grow. However, there’s a downside for earlier investors. Since the paratha (or shares) is now divided into smaller pieces, their share size gets diluted. This concept is called share dilution.

What Is an Offer for Sale (OFS)?

On the other hand, in an OFS, existing shareholders sell their shares to the public without the company issuing new ones. This means there’s no dilution, and the money raised doesn’t go to the company, but directly to the selling shareholders. For example, during Nykaa’s IPO, actress Shilpa Shetty sold her shares in the OFS. The funds she raised didn’t benefit Nykaa but went straight to her.

Now that you understand these fundamental concepts, let’s look at the upcoming IPOs that are making headlines.

- HDB Financial Services IPO

HDB Financial Services, a non-banking financial company (NBFC) under the HDFC Group, is gearing up for its IPO. The company is primarily involved in providing consumer and enterprise loans, asset financing, and micro-lending. It also offers BPO services, like

collections, for unpaid EMIs.

The IPO is a result of a directive from the Reserve Bank of India (RBI), which requires NBFCs classified as “upper layer” to be listed on the stock exchange. This classification is significant as these companies are deemed systemically important, meaning their operations impact the overall economy.

Key Financials:

- Established in 2007, HDB Financial has grown into a major player in the NBFC sector, with 1682 branches across 1148 locations.

- It currently manages assets worth ₹9235 crore and serves 15.5 million customers.

- Revenue in 2023: ₹1417 crore

- Profit Before Tax: ₹3305 crore

- Return on Assets: 3.03%

- Return on Equity: 19.55%

The valuation of HDB Financial’s IPO could be around 5x its book value, meaning the shares might be priced at approximately ₹860-₹864.

- Swiggy IPO

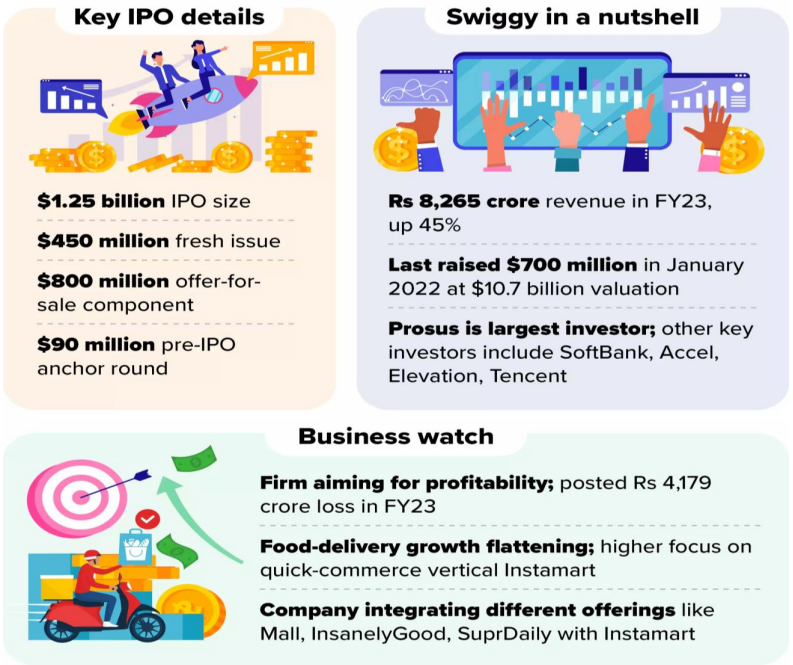

Swiggy, one of India’s top food delivery platforms, is expected to file for its IPO soon. In 2022, the company raised funds at a valuation of $10.7 billion (₹85,000 crore). As competition in the online grocery and food delivery space heats up, Swiggy is preparing to raise around ₹1.4 billion (₹11,729 crore) through its IPO.

Swiggy’s IPO is expected to include both a Fresh Issue and an OFS:

- ₹3750 crore will be a fresh issue, which Swiggy will use for growth and expansion.

- The remaining ₹6664 crore will come from an OFS, where existing investors will sell their

shares.

Notably, Swiggy’s main rival in the food delivery space is Zomato, and together they dominate 90% of the market. With the food delivery industry expected to reach ₹1 lakh crore by 2030, Swiggy’s IPO is eagerly anticipated.

- Leela Palace Hotels IPO

The luxury hotel chain Leela Palace is also set to hit the IPO market soon. Managed by Brookfield Asset Management, Leela Palace has plans for a ₹4000 crore IPO, with a fresh issue portion being used for expansion and growth capital. Additionally, Brookfield may dilute some of its stake through an OFS. Leela Palace, known for its properties in Delhi, Bangalore, Udaipur, and Chennai, was

acquired by Brookfield in 2019. The acquisition marked a strategic turnaround for the brand, with Brookfield now planning to expand its footprint to 20 properties across India.

Conclusion

With these exciting IPOs on the horizon, it’s important to assess your investment strategy. Are you looking for short-term gains, or do you prefer long-term investments? Leave your thoughts in the comments below, and if you find this breakdown useful, make sure to share this post and check out our other educational content on upcoming IPOs!

Remember, investing in IPOs is not about quick wins, but about understanding the company’s long-term potential. If you’re looking for personalized investment advice, always consult a SEBI-registered investment advisor.