Are we heading for another financial crisis ?Understanding the signs and preparing for impacts.

Introduction

In the wake of the 2008 financial crash, the Federal Reserve took swift action by cutting interest rates to mitigate the damage. This move was intended to ensure that companies could secure loans and that the average citizen wouldn’t lose their jobs. However, with the recent trends in the market, many are left wondering: Is there something being hidden from the public? The IT sector alone has witnessed more layoffs in January 2024 than in all of 2023 combined. What does this signify for investors, and could we be on the brink of a crash unlike anything we’ve seen before?

The Pattern of Rate Cuts and Economic Cycles

Historically, interest rates have been lowered after market crashes to stimulate growth. When rates drop, loans become cheaper, spending increases, and businesses can expand.

So, why are we now hearing discussions about a looming recession? Let’s dive into the basics. When interest rates rise, the economy feels pressure: companies halt hiring, layoffs increase, and consumer spending diminishes.

Interestingly, a sudden cut in interest rates, particularly after a long period of stability, can

also signal an impending recession. For instance, back in 2007, the Fed cut rates three

times, only for the market to crash in 2008.

Current Market Dynamics: Is the IT Sector in Trouble?

The tech sector is showing signs reminiscent of the housing market bubble of 2008. While today’s AI and IT companies appear fundamentally strong, there’s a prevailing concern about overvaluation. Amazon, a significant player in the tech landscape, thrived post-dotcom bubble, yet the crash back in 2000 highlighted the need for corrections. Many investors overlooked the signs, leading to a sector-wide collapse.

Currently, experts suggest that the market may face a 20-26% correction. How do we arrive at such a prediction?

Key Indicators of a Potential Crash

- Treasury Bonds: Analyzing U.S. Treasury bonds reveals a worrying trend. The yields on short-term bonds are rising compared to long-term bonds, indicating a lack of confidence in long-term economic stability. This often precedes a market downturn.

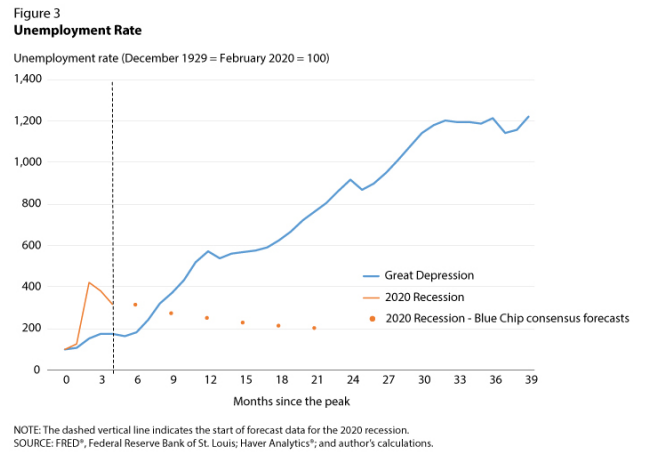

- Unemployment Rates: Historically, when the unemployment rate reaches an all-time low, a crash typically follows within a year. Current trends suggest that layoffs are imminent, as data indicates a reversal in this metric.

- Business Cycles: The current business cycle is displaying signs of reversal. Data from the OECD suggests that if business conditions continue to deteriorate, we could be facing a recession sooner than expected. Many experts are projecting a potential downturn around mid-2025.

Conclusion

As investors, it’s essential to stay informed and prepared. The signals indicating a market downturn are mounting, and understanding these can help you make smarter investment decisions. In the coming weeks, we’ll delve deeper into how to prepare for potential market shifts and protect your investments. For now, keep a close eye on these indicators and consider your strategy moving forward.

Call to Action

If you find this post insightful, share it with fellow investors and subscribe for updates. Stay tuned for our next post where we’ll explore proactive measures you can take to safeguard your portfolio.